Economic Update – First Quarter 2015

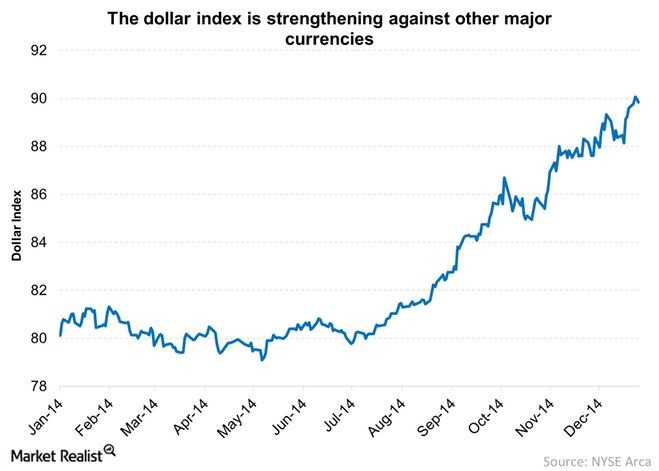

Many market strategists predicted that volatility would return to the equity markets in 2015, and the first quarter proved them right as stocks plunged, soared and then plunged again. During the first 3 months of 2015, the dollar strengthened, oil weakened, and monetary policy became a little less certain.

Many market strategists predicted that volatility would return to the equity markets in 2015, and the first quarter proved them right as stocks plunged, soared and then plunged again. During the first 3 months of 2015, the dollar strengthened, oil weakened, and monetary policy became a little less certain.

By the end of the quarter, the S&P 500 index finished about where it started. However, some of the movements in individual stocks and sectors were extreme. The S&P 500 rose approximately 0.4% for the first three months of 2015, but that benchmark moved at least 1% on nearly a third of the quarter’s trading days, says SunTrust strategist Keith Lerner. This statistic compares with just 15% of all trading days for 2014.

Lerner attributes these turbulent moves to the combination of factors that have become repetitive themes including the rising dollar, falling oil prices and the uncertainty surrounding Federal Reserve monetary policy. “The market can handle one or two things at one time,” he says. “We’ll get a tug of war till there is clarity.” (Source: Barron’s, 3/2015)

The fact that the market has been oscillating by macro forces does not mean that investors cannot succeed. Awareness of how these moves within currencies, commodities and interest rates could affect stocks and sectors can help investors with their decisions. The combination of all forces that took place in this first quarter actually balanced out the S&P 500 return, which is why it finished close to where it started. Still, certain industry sectors were affected more this quarter than others. Some connections are easier to see than others. For example, the energy sector has tracked the price of oil, while utilities, with their large dividends, could be more affected by a rise in interest rates. The fact that investors are concerned that the Fed will raise interest rates at some point in 2015 can help explain why utilities dropped 6% during the first three months of 2015. Similarly, the 10.6% decline in oil prices during the first quarter can be closely connected to the energy sector’s drop of 3.6%. Some sectors were less affected by some of the recent macro risks. Goldman Sachs strategist David Kostin noted that while utilities and energy sectors had high levels of macro risk, consumer discretionary and tech were less susceptible this quarter. The bottom line is still that investors should always be aware and cautious. (Source: Barron’s, 3/2015)

Interest Rates

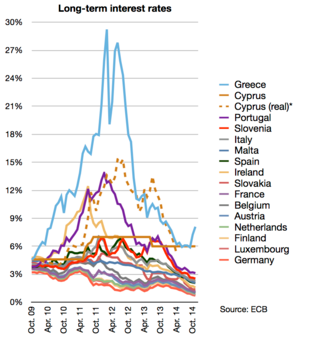

Interest rates and Fed watching continues to play a role for investors in 2015. Ever since the Fed ended its bond buying program last October, investors have been wondering when the Fed will finally raise interest rates. There has been no clear answer and investors still need to be patient. The good news is that the uncertainty that comes before the first rate hike might cause more volatility than the rate hike itself.

The short term interest rate has been 0% since late 2008. In a speech given on Friday, March 27, Federal Reserve Chair Janet Yellen offered conditions for the central bank’s interest rate policy. She said that the initial increase from the 0% – 0.25% target range that was set for the federal-fund rate in December of 2008 should come later this year. She added that the upward trajectory of future rate hikes would be moderate and will depend on incoming economic data.

Yellen felt that equity markets were more pessimistic than the Fed and added that we should not expect a mechanical elevation in rates. She also said that if the data dictates it, the central

bank is prepared to hike rates. (Source: Barron’s 3/2015)

Many economists speculate that an interest rate hike is inevitable in the near future as the job market is doing well, the dollar is strong and home sale values have ticked up. “God forbid something happens in the world and the Fed needs some policy tools to try to aggressively stimulate economic growth here or abroad,” says Phil Orlando, chief equity strategist at Federated Investors. “With the funds rate at zero, they’ve got no bullets to employ. So what they want to do is reload the gun, if you will, and get back to some neutral level of the funds rate over the next couple years.”

Many economists speculate that an interest rate hike is inevitable in the near future as the job market is doing well, the dollar is strong and home sale values have ticked up. “God forbid something happens in the world and the Fed needs some policy tools to try to aggressively stimulate economic growth here or abroad,” says Phil Orlando, chief equity strategist at Federated Investors. “With the funds rate at zero, they’ve got no bullets to employ. So what they want to do is reload the gun, if you will, and get back to some neutral level of the funds rate over the next couple years.”

What’s important to keep in mind is that an interest rate hike is likely still a few months off. Some say the earliest reasonable target date for a rate hike could fall in June, while others speculate the announcement will come closer to the end of this year or even sometime in 2016.

Orlando says the announcement likely will coincide with a meeting and press conference. Federal Reserve Chair Janet Yellen and the Federal Open Market Committee don’t speak with the press after each one of their meetings, so Orlando speculates that an announcement is likely to come out of their June meeting or the session scheduled for September.

If the U.S. Central Bank were to raise rates they would be going against the tide of rate cuts and other monetary-easing measures currently being taken by their counterparts abroad. Specifically, the European Central Bank announced in March the terms of its quantitative easing program. They are instituting this in the face of a negative interest rate environment.

The People’s Bank of China, housed in the world’s second largest economy, became the latest of 20-odd central banks this year to cut rates after a reduction in their growth target to “around 7%.” (Source: Barron’s 3/2015)

The changing of interest rates or even comments suggesting movements continue to create noise and news for investors. As financial professionals, we intend to be very watchful of both the Federal Reserve’s actions and interest rates this year. It seems as if everything is filtered through the lens of monetary policy. For example, when investors learned that the U.S. had added nearly 300,000 jobs in February, the S&P 500 tumbled because it signaled to some that the Fed might be forced to raise rates sooner to curb an overheating economy. Then a lackluster consumer spending report in March caused stocks to surge, because it signaled that the Fed could now afford to wait. “Everyone is playing economist, not trader,” says Michael Block, strategist at Rhino Trading Partners. (Source: Barrons, 3/2015)

Should you have any concerns about your holdings we would be glad to recheck your personal situation during your next review or at any other time.

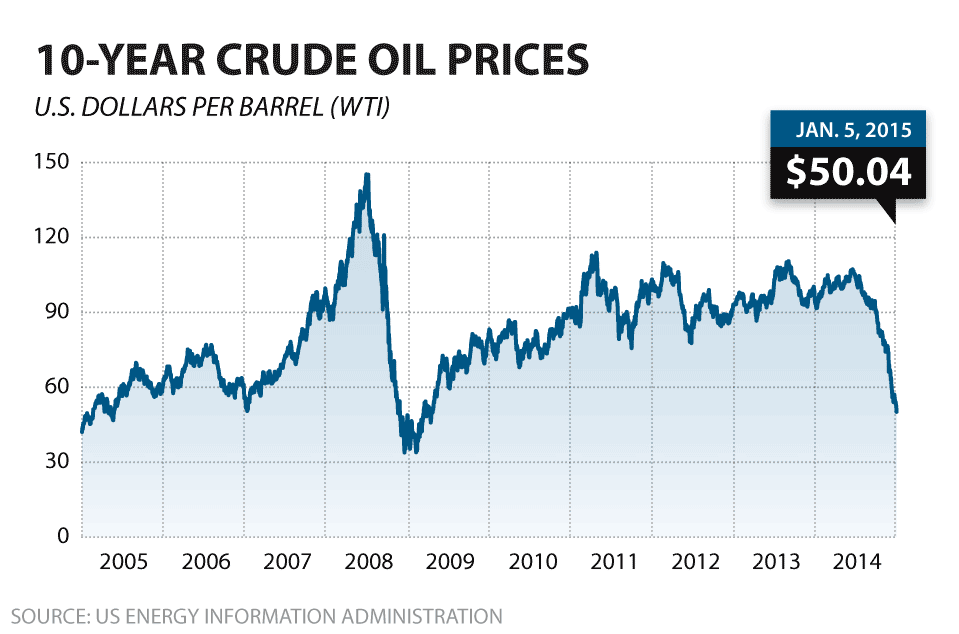

Along with interest rate movements, oil prices continue to be another area that investors should pay attention to. The price of oil, down over 50% in the last seven months, is creating issues beyond even the energy markets.

Moody’s Investors Service analysts link oil’s falling prices to sectors that might benefit from increased consumer purchasing power. With oil prices down and people spending less at the pump, they should have more money in their pockets. “The average U.S. household will spend about $550 less on gas in 2015 than in 2014,” the Moody’s analysts said, citing data from the U.S. Energy Information Administration. They go on to conclude that, “oil price declines act like a tax cut enabling consumers to spend a greater percentage of their incomes on non-energy goods and services.” (Source: Barron’s, 3/2015)

Falling oil prices can hurt those extracting oil and oil service companies. They are expecting lower profits and this could affect jobs. Plummeting oil prices also add challenges for alternative energy sources like solar and wind power suppliers. Lower oil prices have resulted in a decline of many stocks dependent on energy. On the positive side, lower oil prices keep energy costs down for manufacturing companies and transportation companies.

“It’s a net positive for the U.S. economy,” says Don O’Neal, a portfolio manager at American Funds with 33 years of investment experience. He adds that, “It’s really good for the consumer and for a whole range of consumer products. But there is an offset – not all sides are benefiting from low oil prices.” (Source: American Funds, 3/2015)

The fluctuations of oil prices can continue to yield uncertainty for investors. As 2015 continues, this is another area that we will be watchful of.

Earnings and Currency Concerns

Earnings and Currency Concerns

Several market strategists are predicting a rocky earnings season for companies in the first quarter of 2015. The two biggest culprits behind the projected declines are the price of oil and the strength of the U.S. dollar.

The price of WTI (West Texas Intermediate) crude averaged $48.21 for the first three months of 2015 compared to $100.50 in the first three months of 2014, a more than 50% decline. This plunge in price means that energy sector companies have slashed their earnings guidance by 60% according to Dan Greenhaus of BTIG. He adds that overall earnings would rise 2% if you were to exclude the energy sector from the overall results. Meanwhile, the U.S. dollar index averaged $96.14 during the first quarter of the year compared to $80.33 for the same period in 2014 — a 20% year-over-year jump. While this is a great thing for Americans looking to travel or a U.S. company with little to no foreign sales, it’s bad news for a large portion of the S&P.

“The S&P 500 derives about 40% of sales from overseas, therefore relying heavily on global strength,” Christine Short, an analyst at Estimize, explained in a research note. “These companies hail from a variety of sectors — materials, industrials, information technology, consumer staples, and consumer discretionary — proving that the impact will be broad based as almost all sectors will feel forex fluctuations to some degree, with the exception of telecommunications and utilities which are mostly domestically focused,” Short explained.

S&P Capital IQ analyst Sam Stovall wrote in a recent note, “Even though the forecast for S&P 500 EPS (earnings per share) in Q1 is expected to decline 3%, history shows that actual results have been two to four percentage points higher than initial estimates.” He goes on to add that, “As a result, there is still a possibility that EPS will rise, thereby delaying the start of an EPS recession.” (Source: Forbes, 3/2015)

Global Markets

The start of 2015 has suggested that many monetary authorities were becoming responsive to weak growth outlooks and upwards pressure on their currencies. More than 20 countries eased their monetary policy already in 2015, with several countries like Sweden and Denmark even implementing negative interest rates to protect their currencies. (Source: Fidelity, 3/2015)

At the beginning of 2015, the consensus amongst most analysts was that U.S. equities were the place to be. The U.S. economy seemed to be expanding and Europe and the rest of the world did not have the same strength. A recent survey from Bank of America Merrill Lynch infers that a net 19% of global asset allocators are currently underweight U.S. stocks by the largest margins since 2008. This is a dramatic shift from their net overweight positions reported in February. (Source: Barrons, 3/2015)

The current peaking of growth in certain countries has created cause for concern. Inflationary pressures still seem to be absent and corporate profits are still looking solid. On a positive note, the European Central Bank’s quantitative easing program has surpassed market expectations. With the Eurozone emerging from a mid-cycle slowdown, economic sentiment has moved higher in recent months. With the manufacturing sector expanding, a cheaper currency, lower oil prices and banks easing lending standards, Fidelity analysts conclude that though still slow, Europe is showing clear signs of an improving mid-cycle expansion.

The current peaking of growth in certain countries has created cause for concern. Inflationary pressures still seem to be absent and corporate profits are still looking solid. On a positive note, the European Central Bank’s quantitative easing program has surpassed market expectations. With the Eurozone emerging from a mid-cycle slowdown, economic sentiment has moved higher in recent months. With the manufacturing sector expanding, a cheaper currency, lower oil prices and banks easing lending standards, Fidelity analysts conclude that though still slow, Europe is showing clear signs of an improving mid-cycle expansion.

After a multi-year property and credit boom, China seems to be approaching a cyclical downturn. Fidelity’s global market analysis summed up China’s economy by saying, “China continues on a decelerating trend with an elevated risk of a growth recession.”

Japan, on the other hand, seems to be in a mild recession. In April of 2014, the Japanese government implemented a consumption-tax hike that caused a downturn in demand. Although they are in a mild recession, lower oil prices and a weaker yen may have Japan’s economic woes bottoming out.

The weakness in oil has had an effect on many countries worldwide. Those countries that are leading oil exporters are obviously the ones that are being affected the most. The U.S. economy continues to be strong and although analysts are predicting a slowing effect, global growth is still on the positive side. The global backdrop coupled with the weakening of certain countries’ currencies could create further volatility for investors in 2015. While a strong dollar can benefit some sectors, it will adversely affect others. Investors should continue to be watchful of business cycle conditions in both the U.S. and overseas.

Conclusion: What Should an Investor Do?

Ultimately, predictions are just that: predictions. While investors need to be watchful of oil prices, the dollar, and even bad weather, the actual results could end up looking much different than the projections look now. So what can investors do?

Continue to be watchful. Even the most optimistic investors need to be watchful of the warning signs.

Focus on your own personal objectives. During confusing times it is always wise to create realistic time horizons and return expectations for your own personal situation and to adjust your investments accordingly. Understanding your personal commitments and categorizing your investments into near-term, short-term and longer-term can be helpful.

Revisit your risk tolerance. Investopedia defines risk tolerance as an individual having a realistic understanding of his or her ability and willingness to stomach large swings in the value of his or her investments. With the return of more frequent volatility, we would be glad to talk about any changes to your risk tolerance during your next review or at any other time.

Discuss any concerns with us.

Our advice is not one-size-fits-all. We will always consider your feelings about risk and the markets and review your unique financial situation when making recommendations.

We pride ourselves in offering:

- consistent and strong communication,

- a schedule of regular client meetings, and

- continuing education for every member of our team on the issues that affect our clients.

A knowledgeable and informed financial advisor can help make your journey easier. Our goal is to understand our clients’ needs and then try to create a plan to address those needs. We continually monitor your portfolio. While we cannot control financial markets or interest rates, we keep a watchful eye on them. No one can predict the future with complete accuracy, so we keep the lines of communication open with our clients. Our primary objective is to take the emotions out of investing for our clients. We can discuss your specific situation at your next review meeting or you can call to schedule an appointment. As always, we appreciate the opportunity to assist you in addressing your financial matters.

Note: The views stated in this letter are not necessarily the opinion of FSC Securities Corporation, and should not be construed, directly or indirectly, as an offer to buy or sell any securities mentioned herein. Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principal. With any investment vehicle, past performance is not a guarantee of future results. Material discussed herewith is meant for general illustration and/or informational purposes only, please note that individual situations can vary. Therefore, the information should be relied upon when coordinated with individual professional advice. This material contains forward looking statements and projections. There are no guarantees that these results will be achieved. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment.

Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. The P/E ratio (price to earnings ratio is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher P/E ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower P/E ratio. All indices referenced are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. Past performance is no guarantee of future results. The Standard and Poors 500 index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy. The Dow Jones Industrial average is comprised of 30 stocks that are major factors in their industries and widely held by individuals and institutional investors. In general, the bond market is volatile, bond prices rise when interest rates fall and vice versa. This effect is usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.